AI Commissions Fraud Detection Pilot

Designing an AI-driven fraud detection framework for enterprise healthcare

The Challenge

A national health insurer processes tens of millions in monthly commission payments, yet less than 1% of transactions were being monitored for fraud.

Manual audits and threshold-based approvals left major blind spots for bad actors taking advantage of collusion, rerouted payments, and rate manipulation.

The Goal

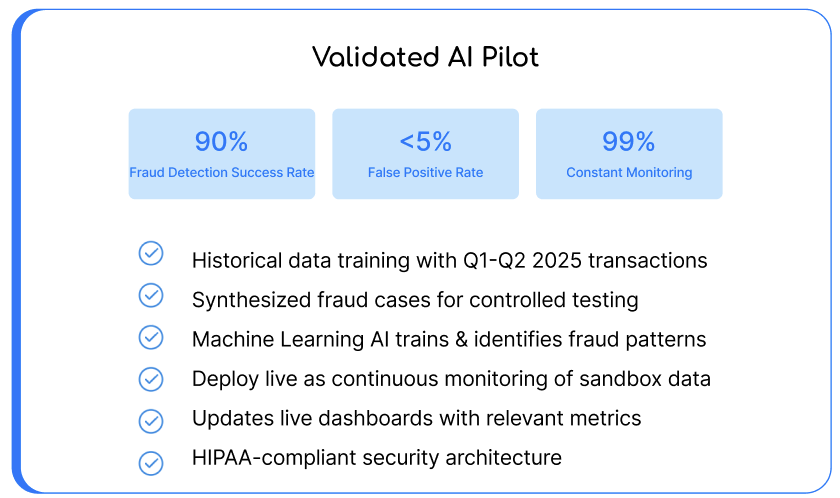

Design and scope an AI pilot to monitor 99% of transactions in real time and improve fraud detection by 15–20%.

The Approach

I led the design strategy and pilot scoping, connecting design, data science, and compliance to define how AI could safely scale inside a regulated enterprise.

My role included:

Stakeholder discovery and workflow mapping

Defining fraud detection logic and model inputs

System architecture mapping and AI flow design

Dashboard concepts for key stakeholders

Pilot presentation and business case validation

System Design

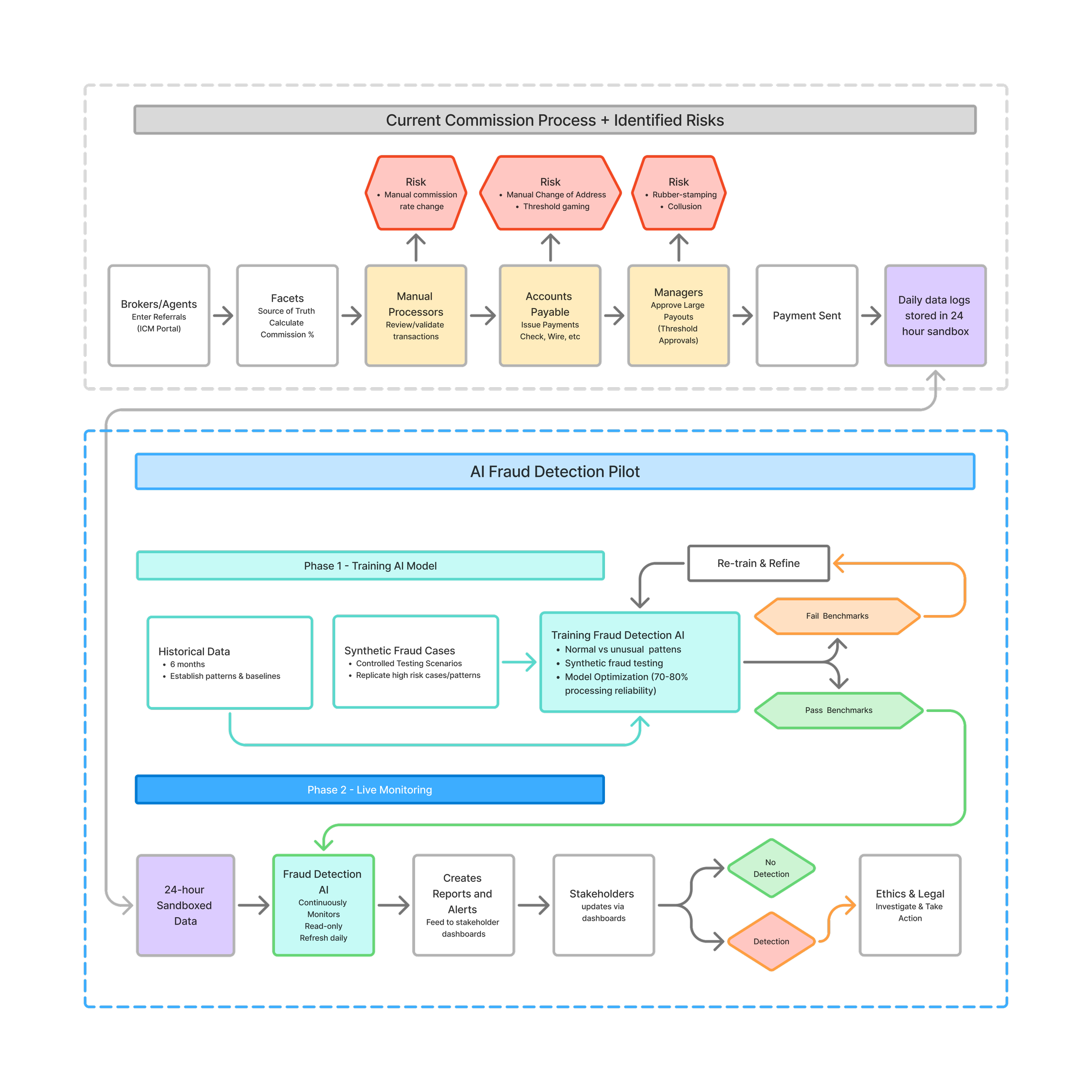

To align teams, I created a visual systems map showing how data would move from ingestion to live monitoring.

It outlined how historical data, synthetic testing, and continuous feedback could train and refine a fraud-detection AI, illustrating the logic in a way that business and technical teams could both understand.

Business Case

The pilot presentation framed the financial risk and opportunity:

$480M annual exposure

37K weekly transactions

<1% currently monitored

The model demonstrated how improving monitoring to 99% could dramatically reduce undetected losses while integrating with HIPAA-compliant infrastructure.

Outcome

The concept received strong validation internally but paused before launch due to enterprise constraints, the company’s infrastructure was restricted to Microsoft Copilot, which couldn’t support custom ML models at the time.

The pilot remains a blueprint for AI service design in healthcare, adaptable to future platforms like Snowflake or Azure ML.